India Today

April 15, 1990

Taxing fracas

Furore over tax summons to Vishwa Hindu Parishad

Harinder Baweja April 15, 1990 | UPDATED 15:59 IST

"A few days ago I served similar summons to Chandraswami. There was no talk of rules then."

Vishv Bandhu Gupta

When Vishv Bandhu Gupta, deputy director of income tax (exemptions), special circle, put his seal on the notice and four summons to luminaries of the Vishwa Hindu Parishad (VHP) - which has close links with the BJP - asking them to appear before the tax authorities, little did he realise he was stirring a hornets' nest.

Following the March 7 summons - which asked the VHP to furnish its income tax returns for 1989-90 and provide detailed accounts for 1988-89 - the BJP-supported National Front Government swung into action.

Within 24 hours, the notice and summons were quashed. In a press note, the director, special circle (exemptions), Tejinder Singh, claimed the notice was not in "accordance with law" and that the "VHP had been filing its return of income regularly".

In the Rajya Sabha, Finance Minister Madhu Dandavate stated that the notice had been issued under Section 139(2) of the Income Tax Act which had been repealed. He added that the official who'd issued the notice had been transferred to Tamil Nadu. Dandavate, however, failed to answer some disturbing questions:

Why were four summons, issued under existing Section 131 of the Act, to VHP office-bearers Ashok Singhal, V.H. Dalmia, Mahant Paramhans and Mahant Nrit Gopal Das quashed? Summons under Section 131 can only be invalidated by a court or if the affected party appeals to the director, income tax (exemptions). In case of an appeal, the assessing officer's explanation is sought. But neither did the VHP appeal, nor was Gupta asked to explain.

The summons had sought details of the VHP's accounts for the year 1988-89 - based on information provided by the VHP itself. In 1988-89, the VHP had shown an income of Rs.22,64,495, an expenditure of Rs.34,67,111 and a corpus fund of Rs.80,003. An additional expenditure of Rs.12 lakh had not been accounted for, the summons stated.

The over-zealousness with which the Finance Ministry quashed the summons casts suspicion on the Government's intentions. The Government denies giving preferential treatment to the VHP. It is, however, reliably learnt that the VHP heard about the summons being served even before it received them.

Senior VHP functionaries are believed to have called up V.P. Singh who, in turn, spoke to Dandavate. VHP General Secretary Ashok Singhal vehemently refutes such charges: "Dandavate is an atheist. Why should he favour us? We are prepared to answer any query."

There are, nevertheless, indications that the Government acted post-haste. As the pressure mounted on March 8 - which was also the day of the VHP demonstration outside Singh's residence to seek a solution to the Ram Janmabhoomi crisis - the Income Tax Department issued a note quashing the notice and the summons.

Later, the 9.30 p.m. news bulletin on Doordarshan carried a report on the case as a 'flash' - something done only under extraordinary circumstances. Also, on the same day, an income tax inspector went to Gupta's residence to collect his office cupboard's keys.

Dandavate denies the Finance Ministry move was prompted by political compulsions. Says he: "Certain laid-down rules have to be followed. The officer had served the notice illegally." Retorts Gupta, who is in charge of 74 trusts including Chandraswami's Vishwa Dharma Yatan and Dhirendra Brahmachari's Vishwayatan Ashram: "As deputy director (exemptions), I have the power to serve the summons.

Only a few days prior to this I served similar summons, under the same section, to Chandraswami. There was no talk of rules and procedures then." To Dalmia's allegation that he is a Congress(I) agent, Gupta counters: "Even as a student, I wasn't a member of any political party."

Income tax officials are reading messages into the Government's actions. An impression has been created that the VHP can't be touched. Says a senior officer: "The VHP has a battery of lawyers available to them. There was no need for the Finance Ministry to play lawyer. Invalid notices have annulment clauses built into them."

There is another aspect to the case: the VHP's application seeking tax exemption because it is engaged in charitable activities is pending with the Income Tax Department. Till the financial year ending March 1986, the VHP enjoyed this status.

In 1987, the Law Ministry noted that no religious organisation could be deemed a charitable trust - yet VHP was exempted. Now, says a Central Board of Direct Taxes spokesman: "The VHP's application is being reviewed." Herein lies the catch.

If the Finance Ministry now grants the VHP the status of a charitable organisation, it will be overruling the Law Ministry's opinion which is supposed to be binding on the Income Tax Department.

If the VHP is not granted such a status, a question arises as to whether the Income Tax Department will issue summons to the VHP. An official press note says that "during the scrutiny of returns, if any information is to be called for, fresh notices will be issued...."

The Government, however, clearly finds itself in a quandary. Private individuals and public organisations have threatened to file a public litigation case against Gupta's transfer and the quashing of summons. And if that happens, it should keep the VHP's pot of controversy on the boil.

Read more at: http://indiatoday.intoday.in/story/furore-over-tax-summons-to-vishwa-hindu-parishad/1/315030.html

skip to main |

skip to sidebar

Communalism all day everyday (hk 2015)

extract from a photo on street

Seeds of Hate - Picture of Bricks collected by the Hindu right Ram Janmabhoomi movement (Photo PTI)

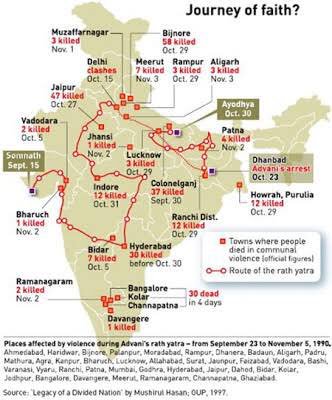

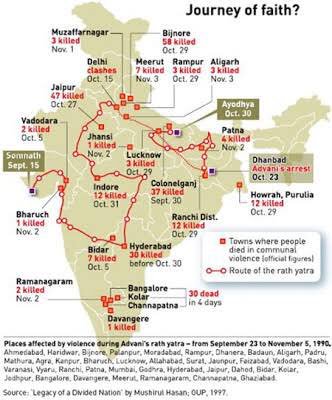

Journey of Faith? - Places affected by violence during BJP's Rath Yatra

Resources for all concerned with culture of authoritarianism in society, banalisation of communalism, (also chauvinism, parochialism and identity politics) rise of the far right in India (and with occasional information on other countries of South Asia and beyond)

Subscribe via email

see Comunalism Watch on mobile phones

Archive

Links

- Fast Track To Troubling Times: 100 Days of Narendra Modi – A Counter Report

- Hindu Nationalism in the United States: A Report on Nonprofit Groups

- Gujarat Carnage 2001-2010

- Communalism Combat

- Anhad

- Sahmat News

- Plural India

- Citizens For Justice and Peace

- Coalition Against Communalism

- For Defence of Teesta Setalvad

- Secular Democracy

- Citizens For Peace

- South Asia Citizens Web

- Truth of Gujarat

- Desh Kosh

- Feku

- Vision Jafri

- Narendra Modi Facts

- Orissa Burning: The anti christian pogrom of Aug-Sep 2008

- Remembering 1992

- Thus Spake Srikrishna

- Janta Ka Aina

- Onlinevolunteers org

- Campaign to Stop Funding Hate

- Awaaz South Asia

- Coalition Against Genocide

- Sangh Samachar

- Stop The Hatred

- Barbarta Kay Virudh: An anti fascist blog in Hindi

- The Pink Chaddi Campaign

- Ban Vishwa Hindu Parishad

- Report of Indian People's Tribunal on Communalism in Orissa

- The Truth on Gujarat 2002 - A Tehelka investigation

- Communalism and Religious Fundamentalism in India: A Resource File [A PDF file]

- Secularism is a women's issue

- Centre for Secular Space

- Human Rights for All

- Gulail

- Holy Cow & Other Bull

- Searchlight Magazine

- Anti Fascist Network

- Ras l'front

Pages

Tags / Keywords

Translate

Feed from Dilip Simeon's blog

Communalism all day everyday

Communalism all day everyday (hk 2015)

See Therapist for "Hurt Sentiments"

Freedom from Hindutva

extract from a photo on street

Seeds of Hate - Picture of Bricks collected by the Hindu right Ram Janmabhoomi movement (Photo PTI)

Map of L K Advani's Rath Yatra of 1990

Journey of Faith? - Places affected by violence during BJP's Rath Yatra

About Us / Disclaimer

This is a collaborative space run by an informal collective of people from across India and elsewhere. The blog was started many years ago under the aegis of South Asia Citizens Web. All web content placed here is done in public interest; it may be freely used by people for non commercial purposes. Please remember to give credit to original copyrighted sources and seek permission for further use.

Disclaimer: Posting of content here does not constitute endorsement by the Communalism Watch Cooperative.

Disclaimer: Posting of content here does not constitute endorsement by the Communalism Watch Cooperative.