The Telegraph, January 29, 2011

Secular nod to Haj subsidy

- Small amount doesn’t violate Constitution: Court

OUR LEGAL CORRESPONDENT

New Delhi, Jan. 28: The Supreme Court has upheld the subsidy given to Haj pilgrims, saying the diversion of a small amount from taxes does not violate the Constitution and pointing out that India is a secular state unlike Pakistan.

Such a diversion does not violate Article 27 of the Constitution that bars any person from being compelled to pay any tax that can be used for any particular religion, the court said.

The Supreme Court was disposing of a petition filed by Prafull Goradia, a former BJP MP in the Rajya Sabha who is no longer associated with the party.

He had challenged the Haj Committee Act on the ground that it violated Articles 14, 15 and 27. Goradia had claimed that although he is a Hindu he has to pay direct and indirect taxes, part of which fund the Haj pilgrimage undertaken only by Muslims.

Upholding the legality of the subsidy, the court said that Article 27 would have been violated if a substantial part of the entire income tax or excise or customs duties or sales tax, or any other tax, were to be utilised for promotion of any particular religion.

Suppose 25 per cent of the entire income tax collected was used for promoting or maintaining any particular religion or religious denomination, it would violate Article 27, the bench said.

“… if only a relatively small part of any tax collected is utilised for providing some conveniences or facilities or concessions to any religious denomination, that would not be violative of Article 27. It is only when a substantial part of the tax is utilised for any particular religion that it would be violated,” the two-judge bench said.

In Parliament last year, foreign minister S.M. Krishna had put the Haj subsidy at Rs 611 crore for 2009-10. The figure is just 0.13 per cent of the Rs 4.65 lakh crore (revised estimates) the Centre collected in taxes in the same year.

The Supreme Court bench noted that the central and state governments also incur some expenditure for Kumbh Mela and the pilgrimage to Mansarovar.

Some states provide facilities to Hindu and Sikh pilgrims to visit temples and gurdwaras in Pakistan. “These are very small expenditures in proportion to the entire tax collected,” the court said.

The court lauded the central government’s stand that it was not averse to the idea of granting support to any pilgrimage conducted by any community.

“In our opinion, we must not be too rigid in these matters, and must give some free play to the joints of the state machinery. A balanced view has to be taken here, and we cannot say that even if one paisa of government money is spent for a particular religion there will be violation of Article 27,” the bench said.

There was “no discrimination”, the court observed, as facilities are also given and expenditures incurred by Central and state governments for other religions, too.

The bench then referred to the origins of the Indian nation state in 1947 to drive home the point that the founding fathers of the country had consciously chosen to declare India a secular state while Pakistan declared itself a Muslim state.

“It is because of the wisdom of our founding fathers that we have a Constitution which is secular in character, and which caters to the tremendous diversity in our country,” Justices Markandey Katju and Gyan Sudha Misra said.

“…when India became independent, there were partition riots in many parts of the subcontinent, and a large number of people were killed, injured and displaced. Religious passions were inflamed at that time, and when passions are inflamed it is difficult to keep a cool head,” the bench noted.

“It is the greatness of our founding fathers that under the leadership of Pandit Jawaharlal Nehru they kept a cool head and decided to declare India a secular country instead of a Hindu country. This was a very difficult decision at that time because Pakistan had declared itself an Islamic state (it became an Islamic republic in 1956) and hence there must have been tremendous pressure on Nehru and our other leaders to declare a Hindu state. It is their greatness that they resisted this pressure and kept a cool head and rightly declared India to be a secular state.

“This is why despite all its tremendous diversity India is still united. In this subcontinent, with all its tremendous diversity (because 92 per cent of the people are descendants of immigrants) the only policy which can work and provide for stability and progress is secularism and giving equal respect to all communities, sects, denominations, etc,” the court counselled.

The bench iterated the sentiments expressed in an earlier decision which said: “Since India is a country of great diversity, it is absolutely essential if we wish to keep our country united to have tolerance and equal respect for all communities and sects.”

o o o

The Times of India

SC upholds central subsidy to Haj pilgrims

TNN, Jan 29, 2011, 03.28am IST

NEW DELHI: The Supreme Court on Friday upheld the constitutional validity of the central government assistance to subsidise air fare of Haj pilgrims which amounted to Rs 300 crores every year.

A Bench comprising Justices Markandey Katju and Gyan Sudha Misra said the amount given as subsidy for Haj was too meagre and could not be termed as a diversion of a major chunk of the income tax to fall foul of Article 27 of the Constitution.

Article 27 says: "No person shall be compelled to pay any taxes, the proceeds of which are specifically appropriated in payment of expenses for the promotion and maintenance of any particular religion or religious denomination."

Petitioner Prafull Goradia had complained that though he was a Hindu, he had to pay direct or indirect taxes, part of which were utilised by the government to subsidize Haj, which was done by Muslims alone.

Dismissing the petition, the Bench said: "In our opinion, if only a small part of any tax collected is utilised for providing some conveniences or facilities or concessions to any religious denomination, that would not be violative of Article 27 of the Constitution."

"Article 27 would be violated if a substantial part of the entire income tax collected in India, or a substantial part of the entire central excise or the customs duties or sales tax or substantial part of any other tax collected in India, were to be utilised for promotion or maintenance of any particular religion or religious denomination," it said.

Referring to the counter affidavits filed by the Centre, the court said the governments incurred some expenditure for the Kumbh Mela and facilitating Indian citizens' pilgrimage to Mansarovar as well as visit to temples and gurudwaras in Pakistan.

For the Kailash Mansarovar Yatra, the Centre gives a subsidy of Rs 3,250 per pilgrim totalling its expenditure to Rs 32.5 lakh. In contrast, it gives a subsidy of Rs 28,000 towards air fare of each of the one lakh Haj pilgrims entailing a total expense of Rs 280 crores on this count alone.

o o o

The Hindu, 29 January 2011

Supreme Court: Haj subsidy not discriminatory

J. Venkatesan

If we wish to keep country united, we need to have tolerance

Spending small part of tax for concessions is not violative of Article 27: Bench

Rs. 280-crore expenditure on Haj, a drain on taxpayers' money: Prafull Goradia

New Delhi: The Supreme Court on Friday dismissed a petition challenging the constitutional validity of the Haj Committee Act, which provides for grant of a government subsidy for pilgrimage every year.

A Bench of Justices Markandey Katju and Gyan Sudha Misra rejected the contention by Prafull Goradia, former BJP Rajya Sabha member, who said such a grant violated Articles 14 and 15 and in particular Article 27 (freedom as to payment of taxes for promotion of any particular religion).

“Severe drain”

The petitioner said he was a Hindu but he had to pay direct and indirect taxes, part of whose proceeds went for the Haj pilgrimage, which was done only by Muslims. For the Haj, “the Indian government grants a subsidy in air fare,” which it could not do. An estimated Rs. 280 crore annually incurred by the government for the pilgrimage was not only unconstitutional but also a severe drain on the taxpayers' money.

Rejecting this argument, the Bench said India was a country of great diversity and “if we wish to keep our country united, we need to have tolerance and equal respect for all communities and sects. It is due to the wisdom of our founding fathers that we have a Constitution, which is secular in character and which caters for the tremendous diversity in our country.”

Secular state

The Bench said: “When India became independent in 1947 there were partition riots in many parts of the subcontinent, and a large number of people were killed, injured and displaced. Religious passions were inflamed at that time, and when passions are inflamed it is difficult to keep a cool head. It is the greatness of our founding fathers that under the leadership of Pandit Jawaharlal Nehru they kept a cool head and decided to declare India a secular country instead of a Hindu country. This was a very difficult decision at that time because Pakistan had declared itself an Islamic state and hence there must have been tremendous pressure on Pandit Jawaharlal Nehru and our other leaders to declare [India] a Hindu state. It is their greatness that they resisted this pressure and kept a cool head and rightly declared India to be a secular state. This is why despite all its tremendous diversity India is still united. In this subcontinent, with all its tremendous diversity (because 92 per cent of the people living in the subcontinent are descendants of immigrants), the only policy which can work and provide for stability and progress is secularism and giving equal respect to all communities, sects, denominations, etc.”

On the petitioner's contention that Article 27 was violated, the court said: “If only a relatively small part of any tax collected is utilised for providing some conveniences or facilities or concessions to any religious denomination, that would not be violative of Article 27. It is only when a substantial part of the tax is utilised for any particular religion would Article 27 be violated.”

Facilities for all Indians

The Bench pointed out that the State government incurred some expenditure for the Kumbh Mela and the Centre, for facilitating Indian citizens to go on pilgrimage to Mansarover, etc. Similarly some State governments provided facilities to Hindus and Sikhs to visit temples and gurdwaras in Pakistan. “These are very small expenditures in proportion to the entire tax collected. Thus there is no discrimination. Parliament has the legislative competence to enact the Haj Committee Act.”

skip to main |

skip to sidebar

Communalism all day everyday (hk 2015)

extract from a photo on street

Seeds of Hate - Picture of Bricks collected by the Hindu right Ram Janmabhoomi movement (Photo PTI)

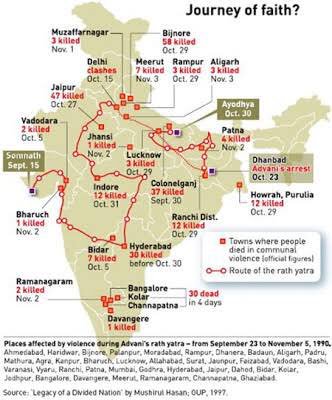

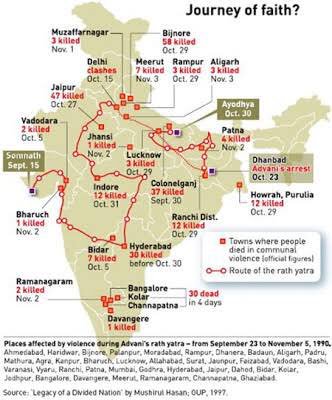

Journey of Faith? - Places affected by violence during BJP's Rath Yatra

Resources for all concerned with culture of authoritarianism in society, banalisation of communalism, (also chauvinism, parochialism and identity politics) rise of the far right in India (and with occasional information on other countries of South Asia and beyond)

Subscribe via email

see Comunalism Watch on mobile phones

Archive

Links

- Fast Track To Troubling Times: 100 Days of Narendra Modi – A Counter Report

- Hindu Nationalism in the United States: A Report on Nonprofit Groups

- Gujarat Carnage 2001-2010

- Communalism Combat

- Anhad

- Sahmat News

- Plural India

- Citizens For Justice and Peace

- Coalition Against Communalism

- For Defence of Teesta Setalvad

- Secular Democracy

- Citizens For Peace

- South Asia Citizens Web

- Truth of Gujarat

- Desh Kosh

- Feku

- Vision Jafri

- Narendra Modi Facts

- Orissa Burning: The anti christian pogrom of Aug-Sep 2008

- Remembering 1992

- Thus Spake Srikrishna

- Janta Ka Aina

- Onlinevolunteers org

- Campaign to Stop Funding Hate

- Awaaz South Asia

- Coalition Against Genocide

- Sangh Samachar

- Stop The Hatred

- Barbarta Kay Virudh: An anti fascist blog in Hindi

- The Pink Chaddi Campaign

- Ban Vishwa Hindu Parishad

- Report of Indian People's Tribunal on Communalism in Orissa

- The Truth on Gujarat 2002 - A Tehelka investigation

- Communalism and Religious Fundamentalism in India: A Resource File [A PDF file]

- Secularism is a women's issue

- Centre for Secular Space

- Human Rights for All

- Gulail

- Holy Cow & Other Bull

- Searchlight Magazine

- Anti Fascist Network

- Ras l'front

Pages

Tags / Keywords

Translate

Feed from Dilip Simeon's blog

Communalism all day everyday

Communalism all day everyday (hk 2015)

See Therapist for "Hurt Sentiments"

Freedom from Hindutva

extract from a photo on street

Seeds of Hate - Picture of Bricks collected by the Hindu right Ram Janmabhoomi movement (Photo PTI)

Map of L K Advani's Rath Yatra of 1990

Journey of Faith? - Places affected by violence during BJP's Rath Yatra

About Us / Disclaimer

This is a collaborative space run by an informal collective of people from across India and elsewhere. The blog was started many years ago under the aegis of South Asia Citizens Web. All web content placed here is done in public interest; it may be freely used by people for non commercial purposes. Please remember to give credit to original copyrighted sources and seek permission for further use.

Disclaimer: Posting of content here does not constitute endorsement by the Communalism Watch Cooperative.

Disclaimer: Posting of content here does not constitute endorsement by the Communalism Watch Cooperative.